2025 Indium-Gallium Nitride (InGaN) Quantum Dot Manufacturing Market Report: Growth Drivers, Technology Innovations, and Strategic Forecasts. Explore Key Trends, Regional Dynamics, and Competitive Insights Shaping the Next Five Years.

- Executive Summary and Market Overview

- Key Technology Trends in InGaN Quantum Dot Manufacturing

- Market Size, Segmentation, and Growth Forecasts (2025–2030)

- Competitive Landscape and Leading Players

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Emerging Applications and End-User Insights

- Challenges, Risks, and Barriers to Adoption

- Opportunities and Strategic Recommendations

- Future Outlook: Innovation Pathways and Market Evolution

- Sources & References

Executive Summary and Market Overview

Indium-Gallium Nitride (InGaN) quantum dots (QDs) are semiconductor nanocrystals that exhibit unique optoelectronic properties, making them highly valuable for next-generation display technologies, solid-state lighting, and quantum computing applications. The global market for InGaN quantum dot manufacturing is poised for significant growth in 2025, driven by increasing demand for high-efficiency, tunable light sources and the rapid evolution of micro-LED and nano-LED displays.

InGaN QDs offer superior color purity, high quantum yield, and tunable emission wavelengths across the visible spectrum, positioning them as a critical material in the transition from traditional phosphor-based LEDs to advanced quantum dot-based devices. The integration of InGaN QDs into display panels enables enhanced brightness, wider color gamuts, and improved energy efficiency, which are key differentiators in the competitive consumer electronics market.

According to MarketsandMarkets, the global quantum dot market is projected to reach USD 10.6 billion by 2025, with InGaN-based QDs representing a rapidly expanding segment due to their compatibility with established GaN-based LED manufacturing infrastructure. The Asia-Pacific region, led by countries such as China, South Korea, and Japan, dominates both production and consumption, supported by robust investments in semiconductor fabrication and display technology innovation.

Key industry players, including Samsung Electronics, Sony Corporation, and OSRAM, are actively investing in InGaN QD research and scaling up pilot production lines to meet anticipated demand from the display and lighting sectors. Strategic partnerships between material suppliers and device manufacturers are accelerating the commercialization of InGaN QD-based products, with a focus on overcoming challenges related to uniformity, stability, and cost-effective mass production.

- Rising adoption of micro-LED and quantum dot displays in premium smartphones, TVs, and automotive panels is a primary market driver.

- Ongoing R&D efforts are focused on improving synthesis techniques, such as colloidal and epitaxial growth, to enhance QD performance and yield.

- Environmental regulations and the push for cadmium-free quantum dots further favor the adoption of InGaN QDs, which are inherently non-toxic compared to some alternatives.

In summary, the InGaN quantum dot manufacturing market in 2025 is characterized by robust growth prospects, technological innovation, and increasing integration into high-value applications, setting the stage for continued expansion and competitive differentiation in the global optoelectronics industry.

Key Technology Trends in InGaN Quantum Dot Manufacturing

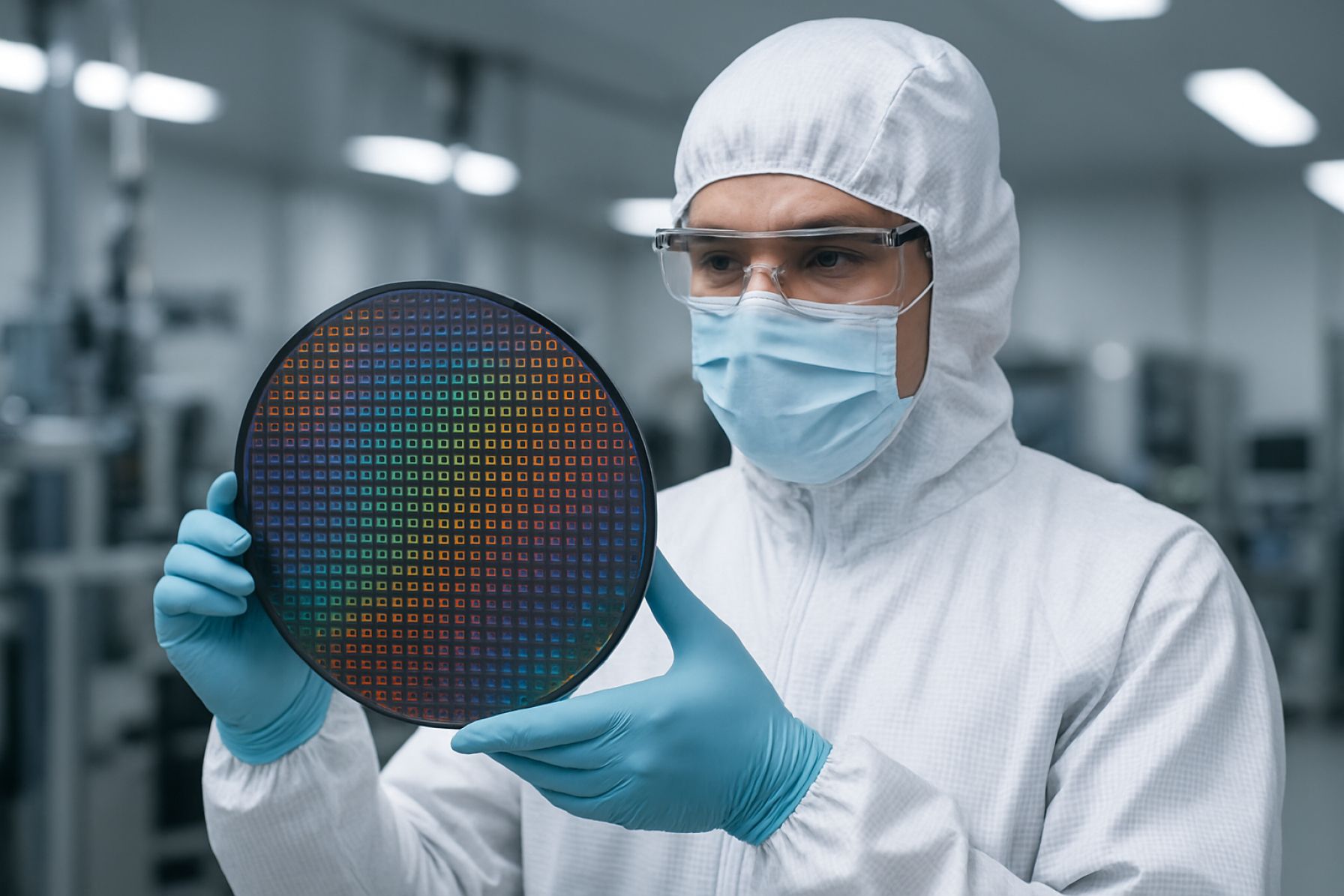

Indium-Gallium Nitride (InGaN) quantum dot (QD) manufacturing is undergoing rapid technological evolution, driven by the demand for high-efficiency optoelectronic devices such as micro-LEDs, displays, and next-generation lighting. In 2025, several key technology trends are shaping the landscape of InGaN QD production, focusing on scalability, uniformity, and integration with existing semiconductor processes.

- Advanced Epitaxial Growth Techniques: Metal-organic chemical vapor deposition (MOCVD) and molecular beam epitaxy (MBE) remain the dominant methods for InGaN QD synthesis. Recent advancements in these techniques have enabled better control over dot size, composition, and density, which are critical for achieving high color purity and quantum efficiency. Innovations such as pulsed MOCVD and atomic layer epitaxy are being adopted to further enhance uniformity and reproducibility across large wafers (OSRAM).

- Strain Engineering and Substrate Optimization: Managing lattice mismatch and strain between InGaN QDs and substrates (typically GaN or sapphire) is crucial for minimizing defects and optimizing emission properties. In 2025, the use of patterned substrates, buffer layers, and compliant substrates is gaining traction, enabling higher-quality QD arrays and improved device performance (Nichia Corporation).

- Monolithic Integration with Micro-LEDs: The integration of InGaN QDs directly onto micro-LED chips is a major trend, aiming to simplify device architecture and boost efficiency. Techniques such as selective area growth and in-situ passivation are being refined to enable seamless integration, reduce non-radiative recombination, and enhance device longevity (Samsung Electronics).

- Scalable Manufacturing and Yield Improvement: As demand for InGaN QD-based devices grows, manufacturers are investing in high-throughput, automated production lines. Inline metrology, real-time process monitoring, and machine learning-driven process optimization are being implemented to improve yield, reduce costs, and ensure consistent quality at scale (ams OSRAM).

- Environmental and Process Sustainability: There is a growing emphasis on reducing the environmental impact of InGaN QD manufacturing. Efforts include recycling of precursor materials, minimizing hazardous waste, and developing greener chemistries for QD synthesis (U.S. Environmental Protection Agency).

These technology trends are collectively enabling the commercialization of InGaN QD-based devices, positioning the industry for significant growth and innovation in 2025 and beyond.

Market Size, Segmentation, and Growth Forecasts (2025–2030)

The global market for Indium-Gallium Nitride (InGaN) quantum dot manufacturing is poised for significant expansion between 2025 and 2030, driven by surging demand in optoelectronics, display technologies, and next-generation lighting solutions. InGaN quantum dots, known for their tunable emission wavelengths and high quantum efficiency, are increasingly favored in applications such as micro-LEDs, laser diodes, and quantum dot displays.

Market Size and Growth Projections

According to projections by MarketsandMarkets, the global quantum dot market is expected to surpass USD 8 billion by 2025, with InGaN-based quantum dots representing a rapidly growing segment due to their superior performance in blue and green emission ranges. The compound annual growth rate (CAGR) for InGaN quantum dot manufacturing is anticipated to exceed 20% from 2025 to 2030, outpacing the broader quantum dot market as commercialization accelerates in display and lighting sectors.

Segmentation Analysis

- By Application: The largest share of InGaN quantum dot manufacturing is attributed to the display industry, particularly for micro-LED and quantum dot-enhanced displays. The lighting segment, including solid-state lighting and automotive headlamps, is projected to witness the fastest growth due to the energy efficiency and color purity of InGaN quantum dots.

- By End-User: Consumer electronics manufacturers, automotive OEMs, and medical device companies are the primary end-users. The consumer electronics segment, led by companies such as Samsung Electronics and Sony Corporation, is expected to dominate market demand through 2030.

- By Geography: Asia-Pacific, led by China, South Korea, and Japan, accounts for the largest market share, driven by robust electronics manufacturing ecosystems and government support for advanced materials research. North America and Europe are also witnessing increased investments, particularly in R&D and pilot-scale manufacturing.

Growth Drivers and Outlook

Key growth drivers include the miniaturization of display components, rising adoption of quantum dot technology in high-end consumer devices, and ongoing advancements in synthesis techniques that improve yield and uniformity. Strategic collaborations between material suppliers and device manufacturers are expected to further accelerate market growth. By 2030, the InGaN quantum dot manufacturing market is projected to become a cornerstone of the advanced optoelectronics supply chain, with new entrants and established players alike investing in capacity expansion and process innovation (IDTechEx).

Competitive Landscape and Leading Players

The competitive landscape of Indium-Gallium Nitride (InGaN) quantum dot manufacturing in 2025 is characterized by a mix of established semiconductor giants, specialized nanomaterials firms, and emerging startups. The market is driven by the increasing demand for high-efficiency optoelectronic devices, including next-generation displays, solid-state lighting, and quantum computing components. Key players are leveraging proprietary synthesis techniques, advanced epitaxial growth methods, and strategic partnerships to gain a technological edge.

- Samsung Electronics has maintained a leading position through significant investments in quantum dot-enhanced display technologies. The company’s QLED TV product line, which utilizes InGaN quantum dots for improved color purity and energy efficiency, has set industry benchmarks. Samsung’s vertical integration and robust R&D capabilities enable rapid scaling and innovation in quantum dot manufacturing (Samsung Electronics).

- Osram Opto Semiconductors is a prominent player in the InGaN quantum dot space, focusing on applications in high-brightness LEDs and laser diodes. Osram’s expertise in epitaxial wafer production and its global supply chain have positioned it as a preferred supplier for automotive and general lighting sectors (Osram Opto Semiconductors).

- Nanosys, Inc. specializes in quantum dot materials and has developed proprietary synthesis processes for InGaN quantum dots. The company collaborates with major display manufacturers to integrate its quantum dots into commercial products, emphasizing scalability and environmental safety (Nanosys, Inc.).

- QD Laser, Inc. is an emerging player focusing on InGaN quantum dot lasers for optical communications and sensing. The company’s innovations in quantum dot laser diodes have attracted partnerships with telecom and medical device manufacturers (QD Laser, Inc.).

- Nanoco Group plc is expanding its portfolio to include InGaN quantum dots, leveraging its experience in cadmium-free quantum dot synthesis. Nanoco’s focus on environmentally friendly manufacturing processes aligns with tightening global regulations on hazardous substances (Nanoco Group plc).

Competition is further intensified by academic spin-offs and regional players in Asia-Pacific, particularly in South Korea, Japan, and China, where government-backed initiatives support quantum materials research. Strategic alliances, intellectual property portfolios, and the ability to meet stringent quality standards are key differentiators in this rapidly evolving market.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for Indium-Gallium Nitride (InGaN) quantum dot manufacturing in 2025 is shaped by varying levels of technological advancement, investment, and end-user demand across North America, Europe, Asia-Pacific, and the Rest of World (RoW).

North America remains a significant hub for InGaN quantum dot research and early-stage manufacturing, driven by robust R&D funding and a strong presence of leading semiconductor and display technology firms. The United States, in particular, benefits from collaborations between academic institutions and industry, as well as government initiatives supporting advanced materials. However, large-scale commercial production is somewhat limited compared to Asia-Pacific, with North American firms often focusing on high-value, niche applications such as quantum dot lasers and next-generation micro-LED displays. Notable players include Nanosys and Nanoco Technologies.

Europe is characterized by a strong emphasis on sustainable and environmentally friendly manufacturing processes, in line with the European Union’s Green Deal and regulatory frameworks. European companies and research consortia are investing in eco-friendly synthesis methods for InGaN quantum dots, targeting applications in energy-efficient lighting and displays. Germany, the UK, and France are leading contributors, with support from organizations such as CORDIS and OSRAM. The region’s market growth is steady, with a focus on quality and compliance rather than sheer production volume.

Asia-Pacific dominates the global InGaN quantum dot manufacturing landscape, accounting for the largest share of production and consumption. This is primarily due to the presence of major electronics and display manufacturers in China, South Korea, Japan, and Taiwan. Companies such as Samsung Electronics, Sony Corporation, and TCL Technology are aggressively investing in InGaN quantum dot integration for high-performance displays and lighting solutions. The region benefits from cost-effective manufacturing, a mature supply chain, and strong government support for semiconductor innovation. According to MarketsandMarkets, Asia-Pacific is expected to maintain its leadership through 2025, driven by surging demand for advanced consumer electronics.

Rest of World (RoW) includes emerging markets in Latin America, the Middle East, and Africa, where InGaN quantum dot manufacturing is still nascent. Activity in these regions is largely limited to research collaborations and pilot projects, with commercial-scale production yet to gain traction. However, as global demand for energy-efficient and high-performance optoelectronic devices grows, these regions may see increased investment and technology transfer in the coming years.

Emerging Applications and End-User Insights

Indium-Gallium Nitride (InGaN) quantum dot (QD) manufacturing is witnessing a surge in emerging applications, driven by the material’s unique optoelectronic properties and the growing demand for advanced photonic devices. In 2025, the landscape is shaped by rapid innovation in display technologies, solid-state lighting, biomedical imaging, and quantum computing, with end-users ranging from consumer electronics manufacturers to research institutions and healthcare providers.

Display Technologies and Solid-State Lighting

- InGaN QDs are increasingly adopted in next-generation micro-LED and mini-LED displays, offering superior color purity, tunable emission wavelengths, and enhanced energy efficiency compared to traditional phosphor-based LEDs. Major display panel manufacturers are integrating InGaN QDs to achieve wider color gamuts and higher brightness, particularly for premium smartphones, televisions, and augmented/virtual reality (AR/VR) devices (Samsung Electronics, Sony Corporation).

- In solid-state lighting, InGaN QDs enable the development of high-luminance, long-lifetime white LEDs with improved color rendering indices (CRI), addressing the needs of architectural, automotive, and specialty lighting markets (OSRAM).

Biomedical Imaging and Sensing

- The biocompatibility and tunable emission of InGaN QDs are unlocking new possibilities in biomedical imaging, including fluorescence-based diagnostics and real-time cellular imaging. Research hospitals and diagnostic device manufacturers are exploring InGaN QDs for their stability and reduced toxicity compared to cadmium-based alternatives (GE HealthCare).

- InGaN QDs are also being evaluated for use in biosensors, where their sensitivity to environmental changes can enhance the detection of biomolecules and pathogens.

Quantum Computing and Photonics

- Quantum dot-based single-photon sources, essential for quantum communication and computing, are a key area of focus. InGaN QDs offer high quantum efficiency and operational stability at room temperature, making them attractive for scalable quantum photonic circuits (IBM, Intel Corporation).

End-user insights indicate that while consumer electronics and lighting remain the largest markets, the fastest growth is expected in biomedical and quantum technology sectors. The adoption curve is influenced by ongoing improvements in QD synthesis, cost reduction, and integration with existing semiconductor manufacturing processes (MarketsandMarkets).

Challenges, Risks, and Barriers to Adoption

The manufacturing of Indium-Gallium Nitride (InGaN) quantum dots (QDs) faces several significant challenges, risks, and barriers that could impede widespread adoption in 2025. These issues span technical, economic, and regulatory domains, each presenting unique hurdles for industry stakeholders.

- Material Uniformity and Quality Control: Achieving consistent size, composition, and emission wavelength in InGaN QDs remains a core technical challenge. Variations in indium incorporation during epitaxial growth can lead to inhomogeneous broadening and reduced device performance. Advanced growth techniques such as molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD) require precise control, but even state-of-the-art systems struggle with reproducibility at scale (OSRAM).

- Scalability and Cost: Scaling up from laboratory to commercial production is hindered by the high cost of precursors, complex fabrication processes, and low throughput. The need for ultra-clean environments and sophisticated equipment further increases capital expenditure. As a result, the cost per unit for InGaN QDs remains significantly higher than for established materials like CdSe or perovskite QDs (MarketsandMarkets).

- Device Integration: Integrating InGaN QDs into optoelectronic devices such as LEDs and displays presents compatibility issues with existing architectures. Challenges include lattice mismatch, thermal stability, and charge carrier injection efficiency. These factors can limit device lifetime and performance, deterring adoption by major manufacturers (Samsung).

- Intellectual Property and Licensing: The InGaN QD landscape is crowded with patents, particularly around synthesis methods and device integration. Navigating this intellectual property environment can be costly and time-consuming, with risks of litigation or licensing bottlenecks (World Intellectual Property Organization).

- Environmental and Regulatory Concerns: While InGaN QDs are less toxic than cadmium-based alternatives, the use of gallium and indium raises concerns about resource scarcity and environmental impact. Regulatory frameworks for nanomaterials are evolving, and future restrictions or reporting requirements could affect supply chains and market entry (U.S. Environmental Protection Agency).

Addressing these challenges will require coordinated efforts in materials science, process engineering, and regulatory compliance to unlock the full commercial potential of InGaN quantum dots in 2025 and beyond.

Opportunities and Strategic Recommendations

The Indium-Gallium Nitride (InGaN) quantum dot manufacturing sector is poised for significant growth in 2025, driven by expanding applications in optoelectronics, displays, and quantum computing. Several key opportunities and strategic recommendations can be identified for stakeholders aiming to capitalize on this dynamic market.

- Expansion in Display Technologies: The demand for high-efficiency, wide-color-gamut displays in consumer electronics is accelerating the adoption of InGaN quantum dots. Companies should prioritize partnerships with leading display manufacturers to integrate InGaN quantum dots into next-generation micro-LED and OLED panels, leveraging the superior color purity and stability of these materials (Samsung Electronics).

- Advanced Manufacturing Techniques: Investment in scalable, cost-effective synthesis methods—such as colloidal and epitaxial growth—will be crucial. Automation and process optimization can reduce production costs and improve yield, making InGaN quantum dots more commercially viable for mass-market applications (MarketsandMarkets).

- Emerging Applications in Quantum Computing and Sensing: InGaN quantum dots exhibit unique quantum confinement effects, making them attractive for quantum information processing and high-sensitivity sensors. Strategic collaborations with research institutions and technology firms can accelerate the development of these advanced applications (IBM).

- Geographic Expansion: Asia-Pacific, particularly China, South Korea, and Japan, remains a hotbed for semiconductor innovation and manufacturing. Establishing local partnerships or production facilities in these regions can help companies tap into robust supply chains and growing end-user markets (Statista).

- Intellectual Property and Regulatory Strategy: Securing patents for novel InGaN quantum dot compositions and manufacturing processes will be essential for long-term competitiveness. Additionally, proactive engagement with regulatory bodies to ensure compliance with environmental and safety standards will facilitate smoother market entry (U.S. Environmental Protection Agency).

In summary, companies that invest in advanced manufacturing, strategic partnerships, and intellectual property protection—while targeting high-growth regions and applications—will be best positioned to capture the expanding opportunities in the InGaN quantum dot manufacturing market in 2025.

Future Outlook: Innovation Pathways and Market Evolution

The future outlook for Indium-Gallium Nitride (InGaN) quantum dot manufacturing in 2025 is shaped by rapid innovation and evolving market dynamics, driven by the expanding demand for high-performance optoelectronic devices. InGaN quantum dots (QDs) are at the forefront of next-generation display, lighting, and quantum information technologies due to their tunable emission wavelengths, high quantum efficiency, and superior thermal stability compared to traditional semiconductor materials.

Key innovation pathways in 2025 focus on overcoming longstanding challenges in uniformity, scalability, and integration. Advanced epitaxial growth techniques, such as metal-organic chemical vapor deposition (MOCVD) and molecular beam epitaxy (MBE), are being refined to achieve precise control over QD size and composition, which is critical for consistent optical properties. Companies and research institutions are also investing in novel substrate engineering and strain management strategies to enhance yield and reduce defect densities, directly impacting commercial viability and cost-effectiveness (OSRAM; Samsung).

On the market evolution front, the adoption of InGaN QDs is accelerating in micro-LED displays, where their narrow emission spectra and high color purity enable superior image quality and energy efficiency. Major display manufacturers are scaling up pilot production lines, with commercialization expected to intensify as manufacturing processes mature and costs decline. The lighting sector is also poised for disruption, as InGaN QDs offer improved color rendering and longer lifespans for solid-state lighting solutions (MarketsandMarkets).

- Integration with Silicon Platforms: Efforts to integrate InGaN QDs with silicon-based electronics are gaining momentum, opening pathways for advanced photonic and quantum computing applications.

- Environmental and Regulatory Considerations: As sustainability becomes a priority, manufacturers are exploring eco-friendly synthesis routes and recycling strategies to minimize environmental impact (International Energy Agency).

- Geographic Expansion: Asia-Pacific remains the innovation hub, but North America and Europe are increasing investments in R&D and pilot manufacturing, aiming to capture a share of the emerging market (IDTechEx).

In summary, 2025 will see InGaN quantum dot manufacturing transition from laboratory-scale breakthroughs to scalable, market-ready solutions, underpinned by technological innovation, strategic partnerships, and a growing ecosystem of end-use applications.

Sources & References

- MarketsandMarkets

- OSRAM

- Nichia Corporation

- ams OSRAM

- IDTechEx

- QD Laser, Inc.

- Nanoco Group plc

- CORDIS

- GE HealthCare

- IBM

- World Intellectual Property Organization

- Statista

- International Energy Agency